“The stock market is designed to transfer money from the Active to the Patient.” — Warren Buffett

In the world of Stock Market Investing, Time and Patience can be your best friends who help to realize the complete potential of your investment. In this blog post, we will delve into some data to understand the reasons why long-term investments tend to be more profitable than short-term investments and trading.

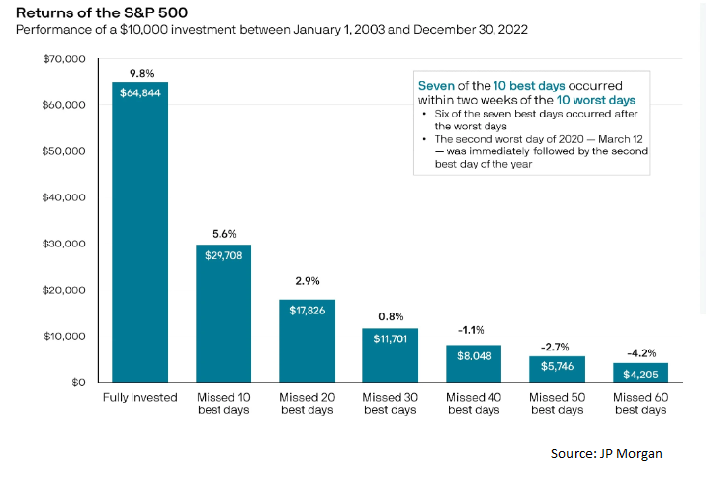

As the very famous quote of Albert Einstein goes “Compound Interest is the eighth wonder of the world. He who understands it, earns it.. he who doesn’t , pays it”. It has been proved time and again that the best way to build wealth and earn in any stock market is to stay invested for a very long time. To substantiate it with data, JP Morgan came up with a chart for the performance of a $10,000 investment, between Jan 1, 2003 and Dec 30, 2022. The below chart illustrates the fund’s performance when invested continuously compared to its performance when missing some of the best days.

There are certainly a lot of us, who get enticed to realize the benefits of trade by timing the market. But it has been proven over and over, even by many experts that it is almost impossible to time the markets. Not only you miss out on the compounding effect if you keep buying and selling stocks, you also have to be extremely accurate about the days the stocks can swing high or low. It is primarily attributed to the volatility of the market , because an upswing and downswing of the stocks can happen in a very short period of time. And it is not easy to predict, even with all the advanced tools and formulae, which days are good to enter and exit the stock. And this strategy carries additional costs such as transaction costs, transaction tax, capital gains tax and so on.

Therefore, the effective strategy to success in Stock Market investment is

- Selecting High Quality Companies to Invest in

- Avoid Speculation

- Embrace the Power of Compounding

Example from My Portfolio:

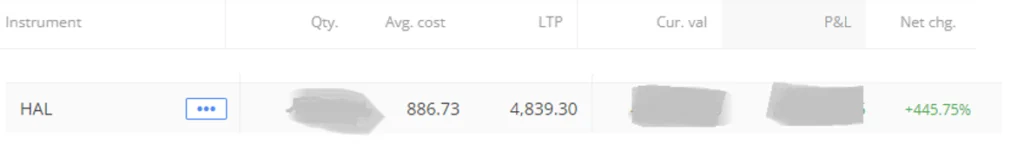

Hindustan Aeronautics Limited has always been one of my favorite stocks ever since I began my Investment Journey.

- I invested X amount in HAL, in Aug 2020, and my average buying price was around 600.

- To my shock and dismay, the stock over the next few weeks will proceed to drop in value, touching a low of 330 in November 2020.

- But since I believed that there was a good potential in the stock and the business has good value, I stayed invested.

- Not only invested, I would even go on and add funds to it systematically every month

- Today as I am blogging, that stock price stands at 4840.

The crucial point is to invest in a reputable company, either through SIP or in a lump sum, and remain invested patiently to enjoy the maximum benefits that the Stock Market has to offer.

In conclusion, always remember that successful investing often requires time and and persistence, but the rewards can be substantial. Embrace the long-term perspective, stay committed to your investment goals, and let the magic of compound growth work in your favor.

Happy Investing!